The number of gasoline stations in Canada grew for the second consecutive year in 2016 after a 10-year decline that resulted in the loss of one in five outlets.

The Kent Group’s annual census showed a net increase of 15 outlets in 2016, taking the total to almost 12,000 or about three stations for every 10,000 people. Just over 100 stations were added in 2015.

The survey by the retail fuel industry consulting firm comes as large refining companies sell their retailing divisions to buyers who continue to use the same brands.

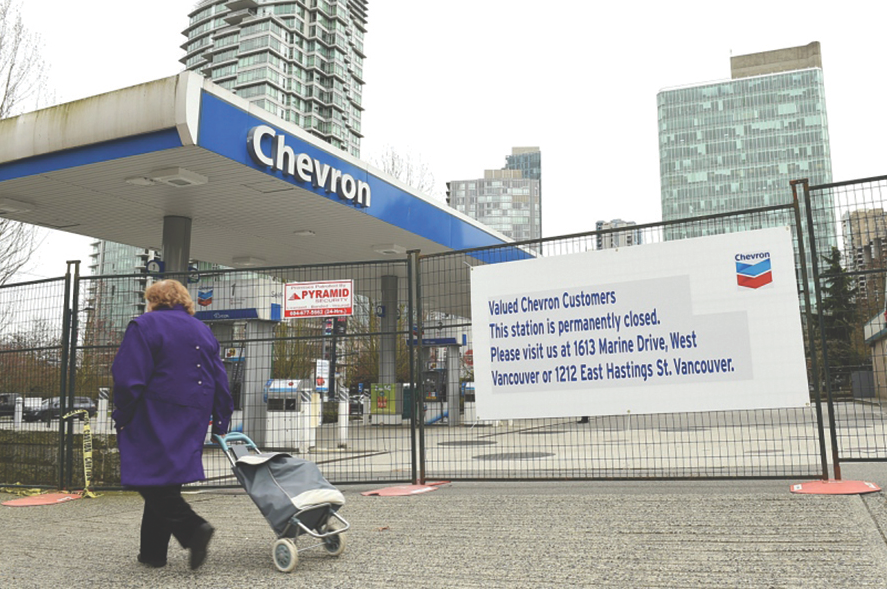

Imperial Oil sold its last 500 Esso-branded retail gas stations to five fuel distributors for $2.8 billion last year. Chevron Canada recently agreed to sell 129 Vancouver-area stations and its B.C. refinery for $1.5 billion to Alberta’s Parkland Fuel.

Although 39 per cent of the stations in Canada sell fuel with brands associated with the three major refining companies — Suncor (Petro-Canada), Imperial (Esso) or Shell — only 11 per cent were owned or managed by them in 2016, the survey says.

Jason Parent, vice-president of consulting for Kent, says the average margin on gasoline has risen to eight or nine cents per litre in the past two years from the 20-year norm of four to six cents, leaving more profits at the pump for the owners.

He says fewer locations are closing these days because higher margins are supporting marginal or low-volume performers.

Parent also said there were fewer gasoline stations opened at big box stores like Costco or Walmart last year.

“The growth in the number of sites has slowed significantly for big box,” he said.

“That said, big box sites are very unique in that they do a ton of volume and they have a big impact on the market even if there are only a couple of them.”