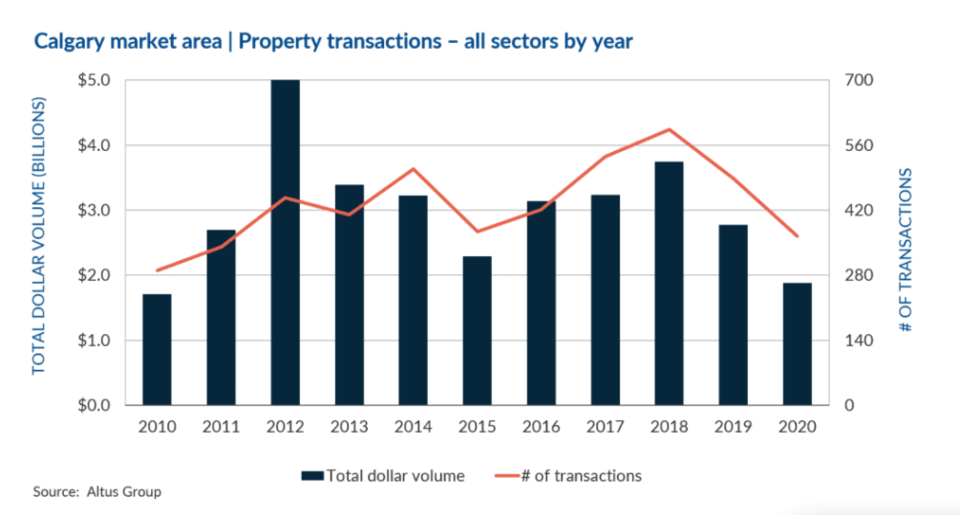

With oil prices slumping and the pandemic still marauding the Alberta economy, Calgary’s commercial real estate market posted the lowest numbers in a decade last year, as total 2020 transactions fell to a value of $1.9 billion.

That, according to an Altus Group report, was down 32 per cent from 2019 to the lowest annual sales volume since 2010. It also marked the third consecutive year of annual declines.

Activity in the fourth quarter 2020 (Q4) was tempered by the reintroduction of strict pandemic curbing measures including the mandatory closure of some non-essential businesses.

Overall, Q4 2020 recorded 87 commercial real estate sales, reaching a total of $410 million.

The multi-family rental sector was the only asset class that posted an improvement, with sales reaching 38 properties totalling $232 million in 2020, up marginally from 2019.

The largest multi-family sale in the fourth quarter was a four-building townhome complex containing 228 units, acquired by Avenue Living for $36 million, which amounts to a price-per-door of $157,894.

The most significant plunge in activity was in the retail sector, due to its higher sensitivity to COVID-19 restrictions. The sector recorded 48 transactions worth $157 million last year, a 48 per cent decrease from 2019.

Investments in Calgary’s troubled office sector, which has the highest downtown vacancy rate in North America, dropped 26 per cent from 2019, reaching a total of $252 million. The reduction in office space needed by oil and gas companies, including due to industry mergers, has helped vacancies balloon to 12 million square feet of empty office space downtown.

Calgary’s industrial sector continued to show relative strength, recording 99 transactions, but the 2020 sales volumes totaled only $559 million, marking a 40 per cent decrease from 2019, according to the Altus Group report.