Alberta is expected to lead Canada's growth this year, according to TD Economics, which is forecasting an increase of 1.9 per cent in the province’s economy this year.

This is the largest of any province in Western Canada, exceeding last year’s tepid growth rate of 1.5 per cent.

A slowdown in the construction sector due to uncertain economic conditions and high costs contributed to last year’s slow growth, as well as contraction in the agricultural sector linked to drought.

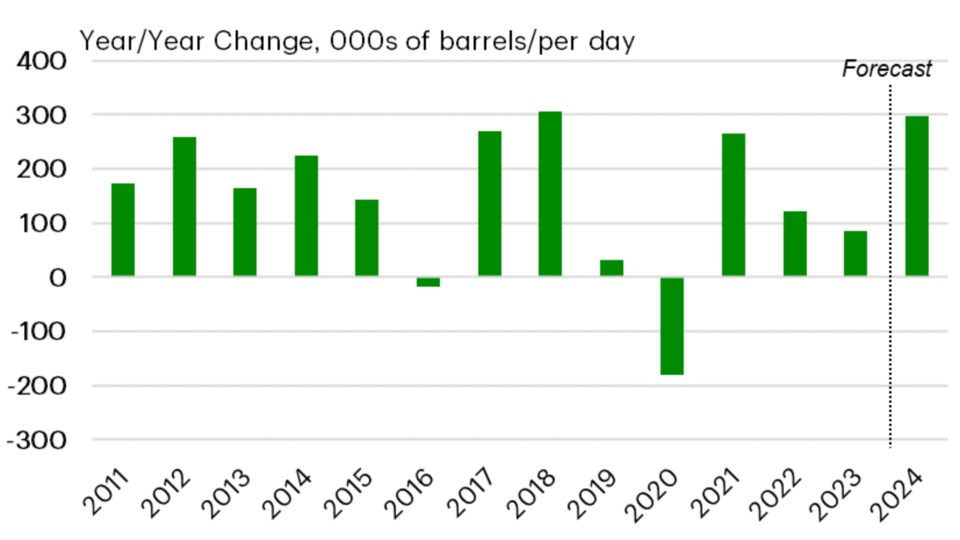

“An expected surge of activity in the oil patch this year will return Alberta to the upper end of provincial growth charts, counteracting early signs of a flagging household sector,” TD Economics forecasted. “Oil output is on pace to record its strongest year since 2018 as the Trans Mountain Pipeline completion boosts overall capacity.”

High costs will continue to dog the construction sector, but real estate investment is on the upswing, particularly in the multifamily sector as the province continues to record strong in-migration.

However, TD says this is also driving up the province’s unemployment rate because hiring simply isn’t expanding fast enough to find places for all those workers.

“The unemployment rate has jumped to 7.2 per cent, the highest in nearly three years,” TD reported. “Population growth at current rates [is] unsustainable and will likely slow over the coming quarters, helping to ease pressure on the unemployment rate.”

It will also ease pressure on the housing supply, though the province continues to see strong growth in rents due to a constrained supply of units.

High interest rates are also keeping some buyers in rented accommodation for longer.

TD’s positive outlook is consistent with the latest quarterly update from ATB Financial, released June 18.

ATB Financial is more bullish than TD, forecasting real GDP growth for the province of 2.5 per cent in 2024 and 2.7 per cent in 2025, outpacing the national growth rates of 1.2 per cent and 1.8 per cent, respectively.

Similar to other observers, ATB Financial believes 2024 will be a “breakout year” for the province’s energy sector after a decade of challenges.

“Oil producers finally have additional pipeline egress as the Trans Mountain Pipeline Expansion (TMX) entered commercial operations in May,” it reported. “Coastal GasLink provides egress for natural gas producers. We see significant improvements to energy production over the next two years, propelling GDP growth.”

A shift towards lower interest rates will also support investment and economic growth, it said, benefitting the province’s housing supply.

“The resurgence in home construction stands as a pivotal driver of Alberta's economic improvement in 2024,” the forecast noted.

The breadth of economic drivers points to the diversification and maturation of the provincial economy into a better-rounded creature than in the past, it noted.

“Despite recent challenges, the provincial economy has been resilient,” ATB Financial chief economist Mark Parsons said. “Looking ahead, Alberta's growth is expected to improve over the next two years, driven by improved market access for energy, increased construction activity, and a broadening economic base.”