While the U.S. sees inflation ebbing, the Bank of Canada isn’t so sure.

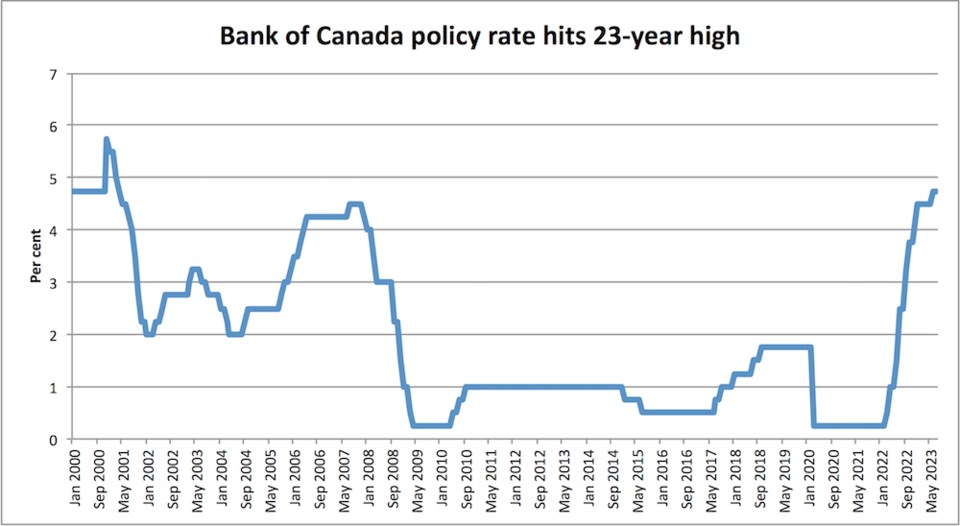

The central bank raised its policy rate another 25 basis points this morning to 5 per cent, the highest since April 2001.

“Global inflation is easing, with lower energy prices and a decline in goods price inflation. However, robust demand and tight labour markets are causing persistent inflationary pressures in services,” the bank statement announcing the increase said.

A key source of demand is the real estate sector, it said.

“While the Bank expects consumer spending to slow in response to the cumulative increase in interest rates, recent retail trade and other data suggest more persistent excess demand in the economy,” the bank noted. “The housing market has seen some pickup. New construction and real estate listings are lagging demand, which is adding pressure to prices.”

Mid-year reports from the major real estate brokerages all point to a dampening effect on construction in Western Canada thanks to higher costs, including the cost of debt.

Building permit data released by Statistics Canada this week also points to a downturn in construction activity, one that’s escalated as interest rate hikes continued this year.

Yet strong immigration, which has resumed in the wake of the pandemic and in tandem with ambitious federal targets, are also playing a role. Canada saw the most immigrants since 1913 last year, federal numbers show, and that’s continued this year.

“Strong population growth from immigration is adding both demand and supply to the economy: newcomers are helping to ease the shortage of workers while also boosting consumer spending and adding to demand for housing,” the bank said.

While higher interest rates are slowing the economy, with the bank forecasting economic growth of just 1.8 per cent for 2023 and 1.2 per cent in 2024, it made clear that inflation’s not dead yet.

But the bank’s governing council is also assessing what inflation may look like in the new normal.

“In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the 2% inflation target,” it said. “The Bank remains resolute in its commitment to restoring price stability for Canadians.”