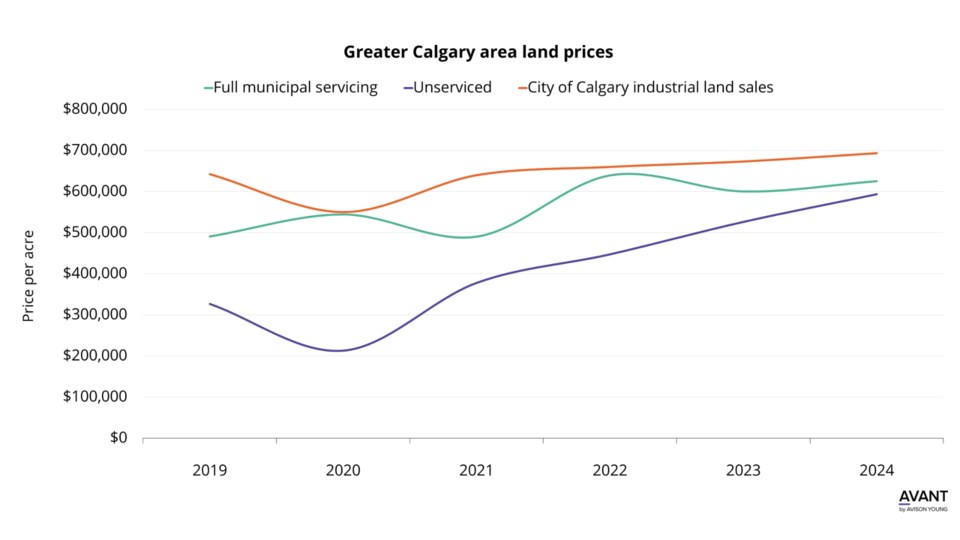

Stabilizing demand and a lower volume of industrial construction is narrowing the gap in price for serviced and unserviced industrial land in the Calgary market.

While overall prices per acre have risen, the gap between serviced and unserviced industrial land as closed in the past four years, commercial brokerage Avison Young reported on August 16.

Serviced industrial land is currently trading at approximately $650,000 an acre, up from $500,000 in mid 2021.

Unserviced industrial land, located primarily outside city limits, is approaching $600,000 an acre, up from $400,000 an acre in mid 2021.

Demand for industrial land is high in the Calgary market, with the majority of supply located northeast of the city in Balzac in Rocky View County as well as surrounding county lands on Calgary’s eastern flank.

Strong demand from owner-occupiers for properties to meet their outside storage needs, including oil service and manufacturing as well as trucking companies, have helped narrow the gap, Avison Young.

“We anticipate the price gap will further narrow as more users absorb more space and as servicing costs continue to increase, pointing to the desirability of both serviced and unserviced land,” Avison Young said.

Constraints on Calgary’s industrial land supply are underscored by Avison Young’s second-quarter report on the city’s industrial market, which indicates that just 65 industrial land sales with an aggregate value of $185 million occurred in the first half of the year.

Barring the pandemic year 2020, this was the lowest tally in a decade.

Yet the demand for industrial space, serviced or unserviced, is underscored by a recent report for brokerage JLL.

JLL data indicates Calgary bucked the trend of rising vacancies seen in many markets this year as the pace of new construction slowed.

“Construction deliveries significantly reduced to 179,967 square feet compared to 2.2 million square feet in Q1 2024,” JLL reported August 8. “Steady demand and a reduction of new vacant space delivered to the market in Q2 resulted in downward pressure on vacancy.”

Vacancies marketwide averaged 3.5 per cent in the second quarter, while availability sat at 5.3 per cent.

Balzac continues to have the highest vacancy rate of 5.5 per cent due to significant recent deliveries. The situation is likely to remain unchanged for the foreseeable future as 64 per cent of the 2.7 million square feet under construction in the Calgary market is happening in the Balzac submarket.

However, the volume of industrial space under construction in Calgary has declined by more than 60 per cent over the past year, promising better times ahead as deliveries decline and demand stabilizes.

“Demand remains strongest among mid and small bay users and developers are expected to respond with more projects geared towards these users,” JLL reported.