Year-end data from commercial real estate brokerage Colliers delivered signs of progress for cities in Western Canada grappling with persistent vacancies in lower-tier office space.

A flight to quality among office tenants has occurred post-pandemic as large volumes of new space became available, but this has left many landlords grappling with older, less desireable spaces. Calgary is the most notable example, introducing conversion and demolition incentives in order to right-size and revitalize its downtown office market.

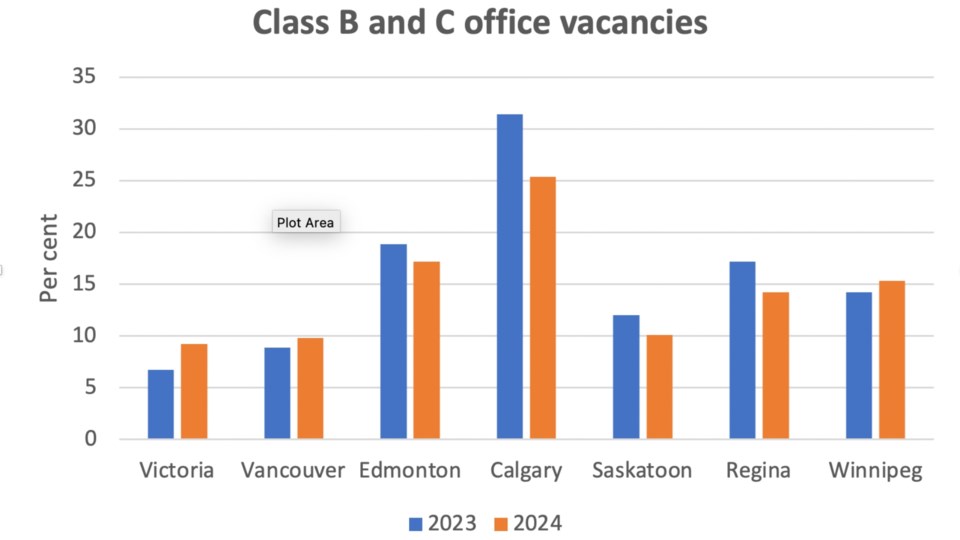

The efforts, as well as recovering demand driven by a stronger economy, seem to be succeeding. Calgary, which had the highest office vacancy rate in the country at 24.2 per cent in the fourth quarter, saw good momentum from tenants with just under 133,000 square feet of positive net absorption downtown. B and C space out-performed the market as a whole, with a total of 297,000 square feet of positive net absorption, the highest for these classes since the final quarter of 2012. Vacancies in these classes stood at 25.4 per cent in the quarter, down from 31.4 per cent a year ago.

Edmonton, Saskatoon and Regina also saw progress, with vacancies in B and C office space edging down by two to three percentage points in each city.

Winnipeg, as well as Victoria and Vancouver, saw vacancies in lower-tier space edge up, in line with the market as a whole as tenants continued to adjust their space requirements.

While office vacancies in downtown Vancouver fell to 11.4 per cent in the fourth quarter, Colliers said the real vacancy rate was actually closer to 12.9 per cent, given an estimated 500,000 square feet of “shadow space” – office space that is vacant but not publicly marketed or advertised.

The result is a favourable market for tenants, Colliers said, especially those seeking space in B and C buildings with less aesthetic appeal, fewer amenities or non-central locations.