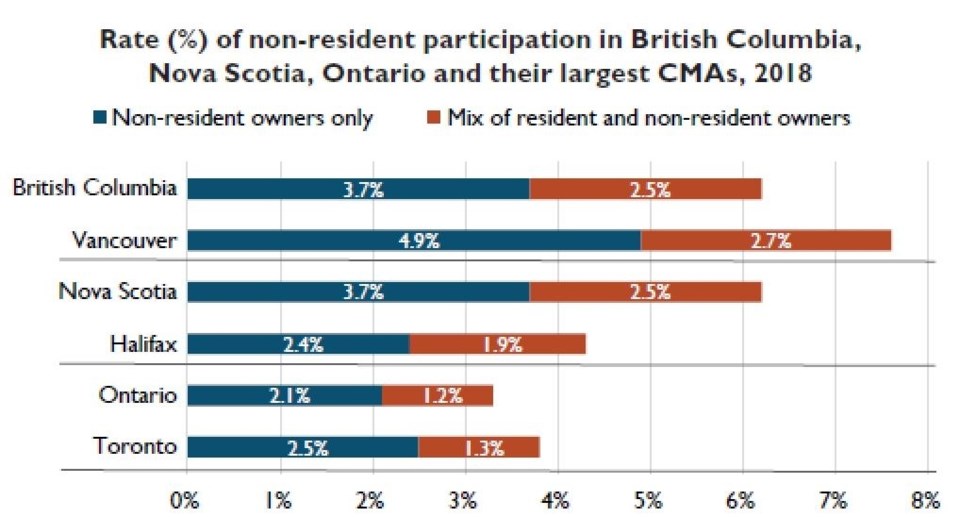

While there is a common perception that overseas buyers have snapped up much of the real estate in B.C.'s major cities, the number of homes in the province owned purely by non-residents is 3.7 per cent, according to a study of Statistics Canada data by Canada Mortgage and Housing Corporation (CMHC), published March 12.

Including homes that are jointly owned by a mix of residents of Canada and non-residents – such as a satellite family where one spouse is resident in Canada, or a local student who jointly owns a home with their overseas parents – adds another 2.5 per cent. This brings the total proportion of B.C. homes with some “non-resident participation” to 6.2 per cent, said CMHC.

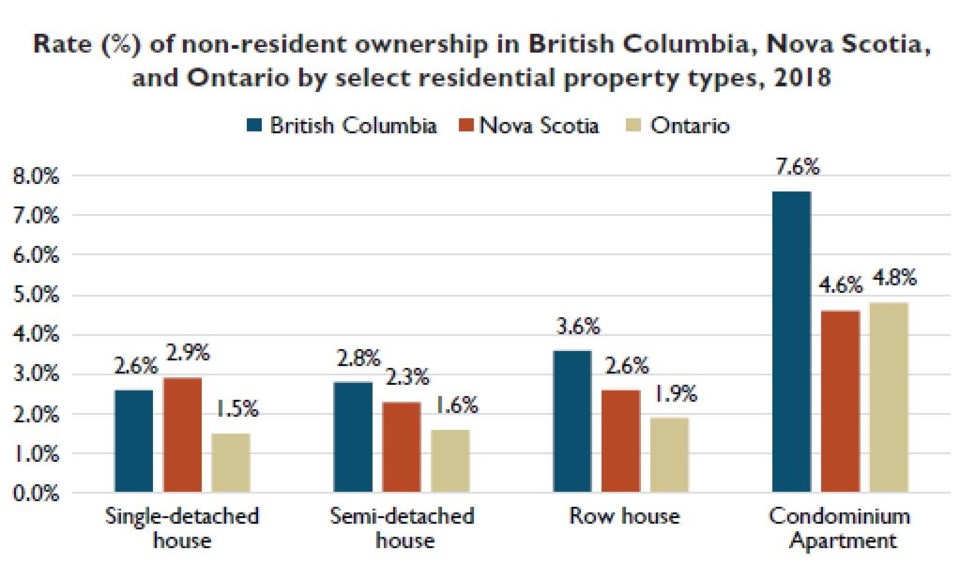

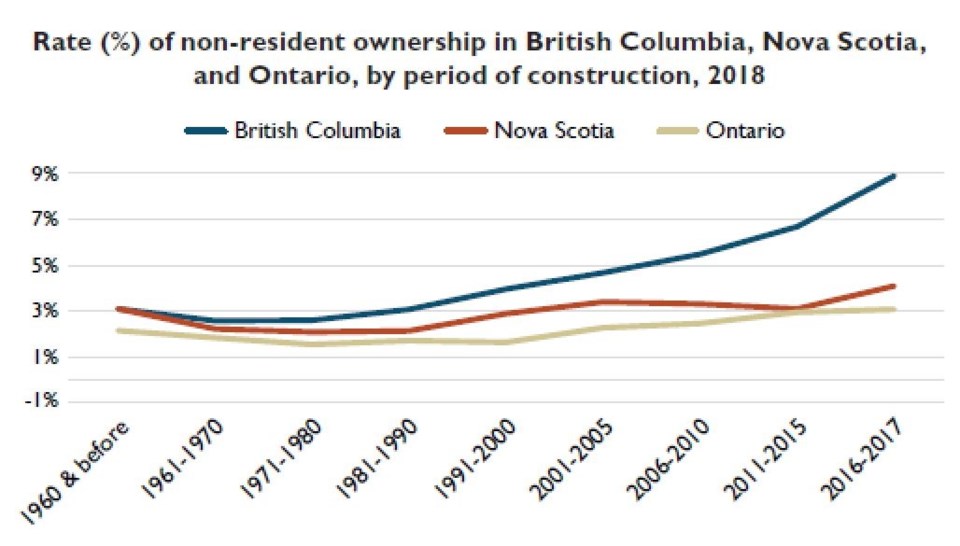

However, the proportion of non-resident ownership varies dramatically when broken out by property type and by year of construction.

Just 2.6 per cent of B.C.’s single-family homes were owned entirely by foreign nationals, compared with condos, where 7.6 per cent were found to be owned entirely by overseas residents.

The share of the province’s homes owned purely by overseas residents was found to increase dramatically among newer properties, rising to a peak of nearly nine per cent built in the frenzied 2016/2017 market.

CMHC found that the median value of homes owned by non-residents in Metro Vancouver and across B.C. was higher than the median value of homes owned by Canadian residents.

The non-resident-owned median assessment value of a single-family house in British Columbia was $236,000, or 36.7 per cent, higher than the median-valued resident-owned detached house in B.C.

The largest assessed value difference between non-resident and resident-owned detached houses is $1,580,000 (31.2 per cent) in the Metro Vancouver Electoral Area A, which includes the UBC neighbourhood and the University Endowment Lands. Vancouver proper saw the second highest value difference, at $1.1 million more than the median resident-owned detached house (22.3 per cent higher).

Aled ab Iorwerth, deputy chief economist at CMHC, said, “The data allows us to better understand the role of non-residents as a component of demand in Canadian housing markets, a topic that is of public interest in terms of the source of funds and the investment behaviour associated with such properties.”