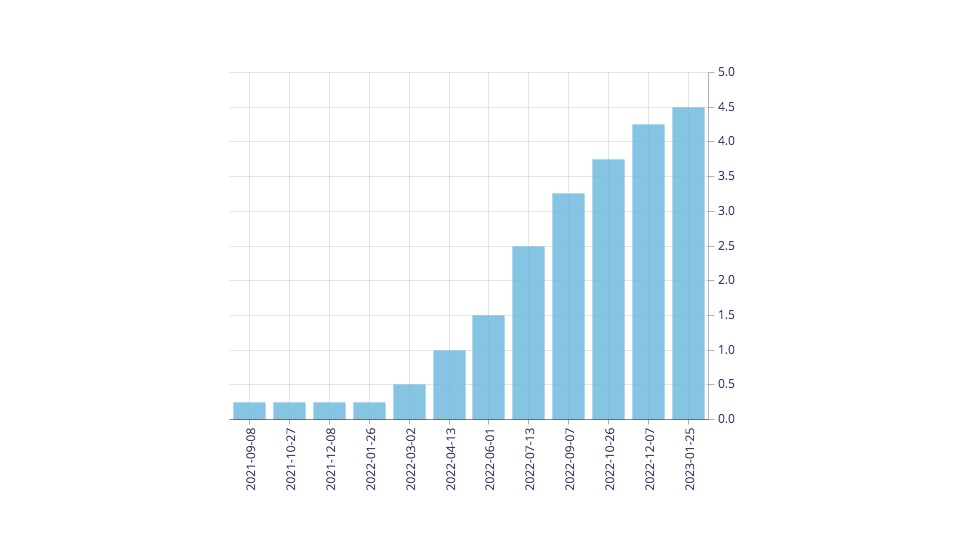

The Bank of Canada’s decision to hike its policy rate hike by a further 25 basis points this morning once promises to extend the downturn in real estate markets across the country as lending remains expensive.

The bank’s target overnight or policy rate now stands at 4.5 per cent, 18 times what it was a year ago.

In a statement announcing the increase, the bank attributed the latest decision to the ongoing strength of inflation globally, and recent economic growth in Canada it described as “stronger than expected.”

This morning’s announcement was the eighth consecutive increase since it began hiking rates in March 2022, but also the smallest since the initial increase. The last increase on Dec. 7 was 50 basis points, meaning today’s increase is a marked deceleration in the rise.

The effect of higher interest rates is helping cool the economy to a point where the bank believes it will be able to hold the line rates.

“There is growing evidence that restrictive monetary policy is slowing activity, especially household spending,” the bank reported. “Consumption growth has moderated from the first half of 2022 and housing market activity has declined substantially.”

The announcement included a clear signal that today’s increase may be the last for a while, providing inflation continues to decrease and economic growth slows.

“Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases,” the bank said.

This would be good news not just for consumers, but real estate investors.

Transaction activity slowed across major investment markets in Canada in the latter half of 2022. Within Metro Vancouver, Altus Group reported investment sales down 39 per cent from a year earlier in the third quarter and down 4 per cent in the year to date.

“The macroeconomic headwinds that have been building since the start of the year have finally impacted investor sentiment to such an extent that a significant drop in dollar volume in the third quarter was the result,” said Andrew Petrozzi, director, commercial research, Western Canada with Altus, in his analysis.

The slowdown was expected to continue into the fourth quarter, but this morning’s Bank of Canada announcement promises a more stable environment.

“The pace at which the interest rates increased over the past number of months have had some cooling effect on the overall sales market,” Jason Kiselbach, senior vice-president and managing director with brokerage CBRE Ltd. in Vancouver said. “If the interest rate increases stabilize it’s a positive for the market, because the cost of capital is known versus moving. … That will be the positive indicator people are looking for.”

The series of interest rate hikes over the past year mark the sharpest increase in rates in a generation, shocking markets into a prolonged pause.

Speaking at the Vancouver Real Estate Forum last April, CIBC deputy chief economist and managing director Benjamin Tal said the speed of the increase was the biggest risk to investors.

“Your enemy is not higher interest rates. Your enemy is rapidly rising interest rates,” he said, hoping at the time for a short, sharp hike followed by a pause to assess its impacts. An increase to 2.25 per cent would likely be enough to rein in inflation and stabilize the economy, he said.

“With the increased sensitivity to higher interest rates, that might be enough. You go beyond that and you risk a recession in 2023,” he said.

Many observers expect recessionary influences to persist through the first half of 2022, but the Bank of Canada expects net growth in the economy this year of 1 per cent. It expects inflation to 3 per cent by mid-year, down from 6.3 per cent today.

The next scheduled rate announcement from the Bank of Canada is set for March 8.