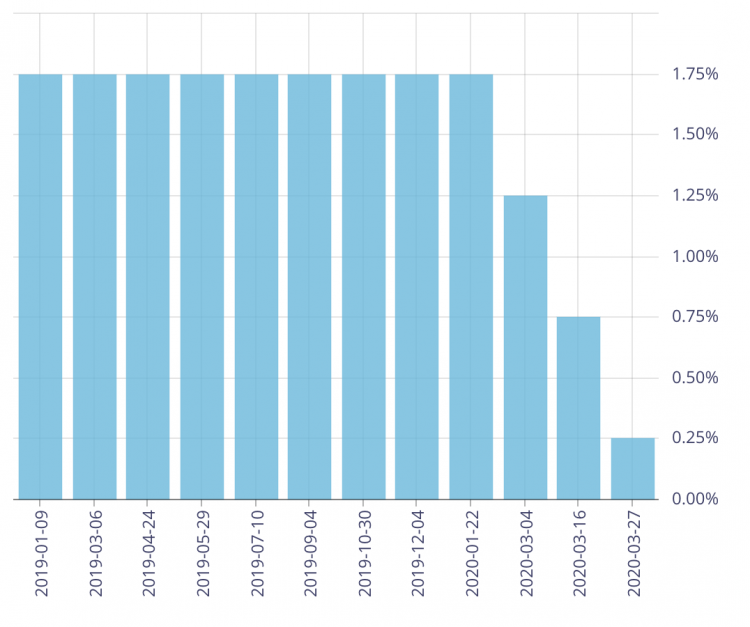

The Bank of Canada cut its key interest rate by 50 basis points on Friday March 27. This is the third 50-basis-point cut this month as the bank does what it can to ease the cost of borrowing during the ongoing COVID-19 pandemic.

The unscheduled rate decision brings the bank’s policy interest rate down to 0.25 per cent. At 0.75 per cent, it was the highest such rate among the central banks of G7 countries.

On Friday, Canada’s central bank also announced two new programs to bring greater liquidity to Canadian markets: the Commercial Paper Purchase Program (CPPP), and a quantitative easing program.

Under the latter, the bank will purchase a minimum of $5 billion in Government of Canada securities per week, starting April 1. The program will continue until Canada’s economic recovery is “well underway.”

Over the next 12 months, the CPPP will see the bank undertake primary and secondary market purchases of commercial paper issued by Canadian firms, municipalities and provincial agencies that have an outstanding commercial paper program. Poloz said the program will “help to restore a key source of short-term funding for businesses.”

“The intent of our decision today is two-fold: to immediately support the financial system so it keeps on providing credit, and, over the longer term, to lay the foundation for the economy’s return to normalcy,” Bank of Canada governor Stephen Poloz said in an opening statement to media.

Although existing variable-rate mortgage holders will enjoy additional discounts from the BoC's new rate, whether or not the cuts will be passed on to new mortgage consumers remains to be seen. Thus far, despite two previous recent rate reductions of 50 basis points each, mortgage rates for new customers have been rising, not falling.

“This is a very uncertain time for banks and lenders, just as it is for consumers,” said Alex Conconi, CEO of Lendesk. “While the normal consequence of a Bank of Canada prime rate cut is to pass that on to borrowers, at the end of the day, banks control their own prime rate and it cannot be taken for granted amid COVID-19. Moreover, until recently, it wasn’t unusual to see variable rates that were prime minus something: now that has all but evaporated, and we’re seeing prime plus a spread. The consequence is that the banks are able to shore up some margin, which may be necessary if they are to take losses in other parts of their business. Meanwhile, consumers aren’t necessarily paying any less than they would have been paying a few months ago.”

With files from Glacier Media Real Estate