Around 18 months of steady overnight rate rises have led mortgage holders and applicants to brace themselves for bigger monthly payments. But five-year fixed rates, held by 80 per cent of homeowners, are in fact declining because of a fall in government bond yields, which dictate fixed rates, according to the B.C. Real Estate Association.

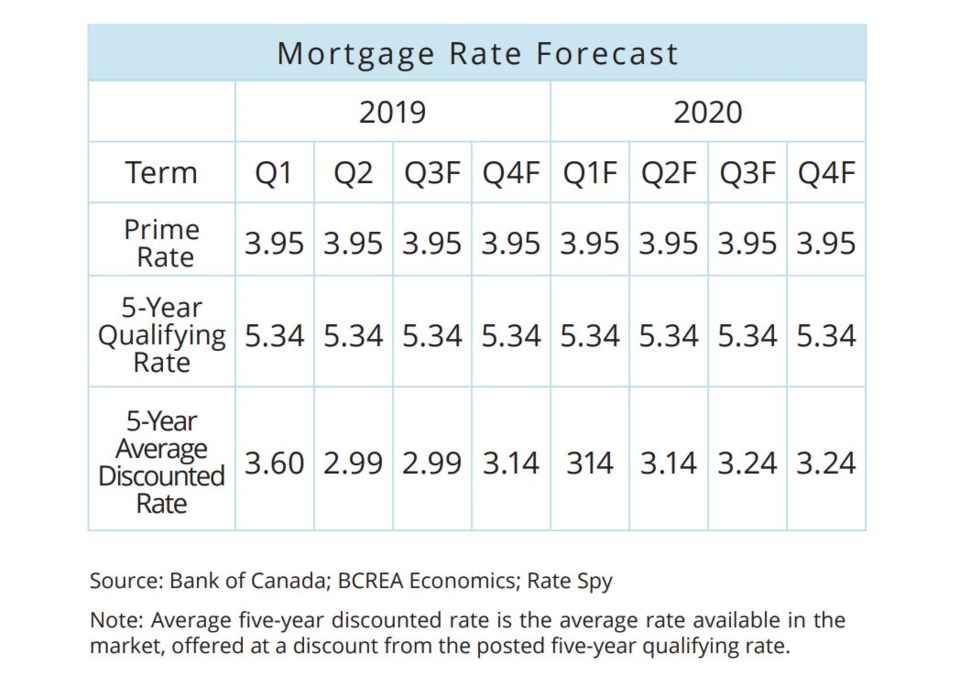

In its latest quarterly Mortgage Rate Forecast, issued June 28, the BCREA reported that the average five-year fixed rate for 2019’s second quarter will have been 2.99 per cent, down from Q1’s 3.60 per cent. That rate is expected to stay the same through summer to September, and the declines are even steeper than those predicted in BCREA’s March forecast.

However, the association is predicting that five-year fixed-rate mortgages will begin to climb “modestly” again in the fall, with an average of 3.14 per cent in 2019’s fourth quarter, and the same in the first six months of 2020.

Despite this, the Bank of Canada’s five-year posted (qualifying) rate is expected to remain unchanged all the way through to the end of next year, at 5.34 per cent. This means that mortgage applicants undergoing the stress test will have to qualify at that rate, even if they are only paying around three per cent as a contracted rate.

The BCREA’s report said, “As currently constituted, the mortgage stress test is the higher of the contract rate plus two per cent or the posted five-year mortgage rate. The latter has not changed in close to a year despite the drop in five-year bond yields. In fact, the posted rate appears to be divorced from its prior statistical relationship with the five-year bond yield.”

The association reiterated its many previous calls for the federal government to ease the mortgage stress test. It wrote in the report, “Our models imply that the five-year posted rate should be 4.84 per cent, rather than the current 5.34 per cent. Not only would a lower posted rate help insured buyers to qualify, but it would provide a significant boost to the uninsured market through a lower stress test rate.”

The association also suggested a cut to the Bank of Canada’s overnight rate – which affects variable-rate mortgages – could be on the cards.

The report said, “With market expectations at odds with communication from the Bank of Canada, its worth asking, ‘Is it time for the Bank of Canada to cut interest rates?’ The argument in favour of lower rates is a growing risk of recession, caused by an exogenous shock like the escalation of global trade disputes, when the Bank has limited ammunition to boost the economy.”