For decades, existing apartment buildings have been the most sought-after asset class by investors and led the market with the lowest cap rates. What is changing is the feasibility and economics of constructing purpose-built apartments. New purpose-built rental construction financing programs are turbocharging the purpose-built rental market.

Municipal support

Municipalities are encouraging purpose-built rental construction by creating incentive-based programs to promote the private-sector development of housing. In some municipalities the only requirement is that the building remain a market-rental apartment for the long term (no option to convert to condo). Some municipalities are integrating affordability and low-income options in all of their rental programs. Every municipality is taking a different approach. For example, in Vancouver, the Rental 100 program sets the rental rates at their deemed affordable rate, development cost levies are waived, parking and unit size requirements are reduced and an increase in density is considered, making these projects more affordable for renters and more appealing to developers.

The CMHC advantage

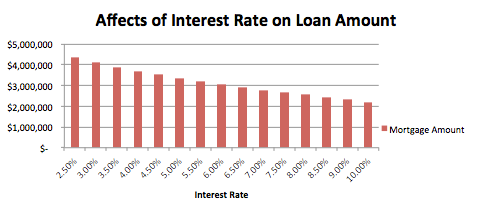

With Canada’s interest rates expected to rise, the income-based tests will start to decrease loan amounts. Thankfully, Canada Mortgage and Housing Corp. (CMHC) insures both construction and term financing, creating very attractive and affordable funding for the development, renovation and acquisition of rental buildings. Currently, Citifund is placing insured mortgages for 2.62 per cent (five-year rate) and 2.83 per cent (10-year rate) both using the March 5 bonds. As a comparison, the conventional term loan-pricing premium is even wider than normal with approximately 3.3 per cent (five-year rates) and 4.1 per cent (10-year rates).

On new or renovated buildings 30-year amortizations are available on an exception basis and CMHC will allow up to 40-year amortizations.

CMHC’s new products

CMHC has also developed two new insured construction-financing programs for purpose-built rental projects. The first, the Rental Construction Financing Initiative (RCFI) program, is a federally backed CMHC direct lending program for new projects only.

Within this program, CMHC will offer up to 100 per cent of total project cost financing, which is restricted only by the debt service ability of the end product, and not the value. With this program, CMHC uses up to a 50-year amortization, a 1.10x debt service ratio and today’s 10-year rate, which provides exceptional leverage. A major benefit to this program is that the 10-year term rate is set and held from the first construction advance, thus removing any interest rate risk through construction and rent up. In order to qualify for this program, a social outcome point system determines which projects are awarded. Points are awarded for affordability, viability, accessibility and the environmental aspects of the project. While not necessarily easy to qualify for, the construction rate-lock feature and loan-to-cost flexibility makes RCFI simply a “dream come true” for construction financing.

The second CMHC construction-financing offering is the Affordable Mortgage Loan Insurance (MLI Flex) program. This option offers a higher-leverage product at lower premiums for construction and term financing for to-be-built or recently completed rental product. CMHC offers up to 95 per cent of cost financing restricted by a 1.10x debt service ratio and a 40-year amortization and reduced CMHC premiums. To qualify for MLI Flex, total rents need to be 10 per cent below market and 20 per cent of the rents below the 30 per cent median family income for the area, or the development is approved under a government affordable rental program. These affordability criteria must be maintained for 10 years.

Also, conventional construction loans are available for the development or renovation of rental buildings. All loans are subject to the borrower’s financial strength, the property and lender requirements.

Previous: Kitimat's coming boom

Next: Multi-family investing (Vancouver)