Morguard has released its Canadian Market Outlook and Market Fundamentals report for 2020 and it is relatively bullish on the commercial real estate market.

“Commercial real estate remained one of the most attractive and stable long-term investments in 2019 and will continue to attract interest from investors in 2020,” said Keith Reading, director of research at Morguard. “The real estate industry, along with the Canadian economy, continued to expand in 2019 despite the global trade dispute and challenges in the oil and gas sector impacting domestic business confidence. However, an improvement in the troubled energy sector is anticipated for 2020.”

The industrial asset class experienced an extension of the bullish phase of its investment cycle as investors continued to bid on available properties with confidence, following record-high annual transaction volume of $12.7 billion in 2018. In 2020, sales activity is expected to remain brisk, continuing the trend of the past few years.

In the office market, investment sales activity continued at a record pace in 2019. Canadian office leasing fundamentals continued to strengthen against a backdrop of regional disparity, with the national average vacancy down appreciably.

“Continued changes in consumer spending habits, e-commerce and demographic shifts forecasted for 2020 have reinvigorated the retail environment. Retail owners are introducing a new consumer experience in the tenant mix and more service retail among other measures to engage shoppers and keep up with industry changes,” added Reading.

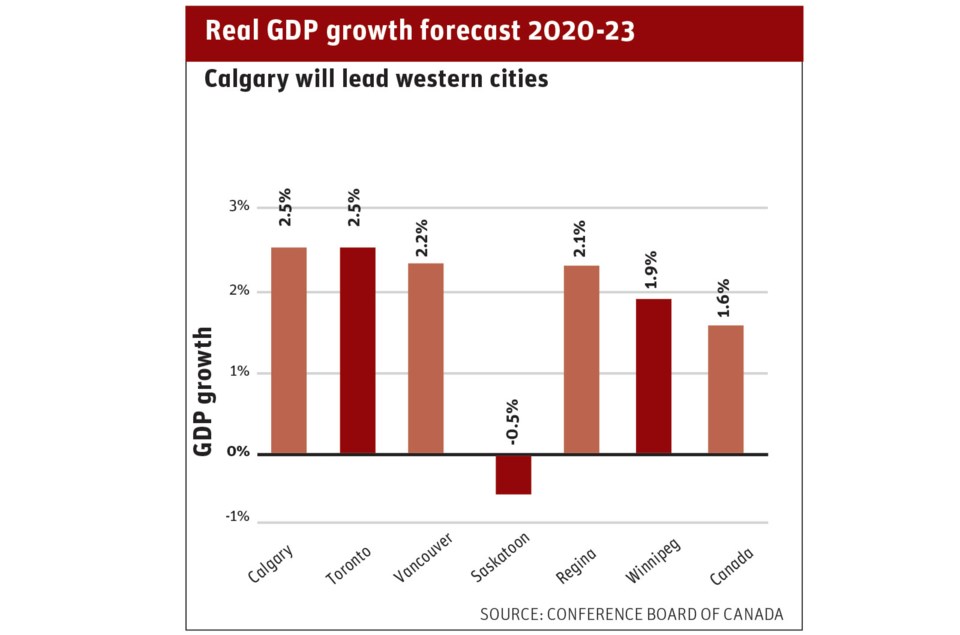

Consumer spending growth is expected to increase in 2020, driven by continued wage growth and low interest rates. Canada’s labour market performed extremely well in 2019, seeing the lowest unemployment rates in the last 50 years. Canadian GDP is forecast to grow by 1.6 per cent overall, led by Calgary, Toronto and Vancouver, according to the Conference Board of Canada.