The Alberta economy is on the mend and the evidence can be seen in an uptick of real estate investments in the province’s big cities, but the Alberta Treasury Branches (ATB) cautions that the recovery will be muted.

“There is little question that Alberta’s economy has rounded the corner and the worst recession in three decades is now squarely in the rear-view mirror,” ATB noted in its Alberta Economic Outlook, released in August. ATB Financial is forecasting real GDP growth of 3.2 per cent this year, followed by a more modest expansion of 2.1 per cent in 2018, in cautioning, “Alberta’s economy is unlikely to recover to its pre-recession levels this year.”

So how is the modest recovery playing out in Calgary and Edmonton real estate investments? Based on recent data, it appears the two cities are running neck and neck with Edmonton poised to take the lead.

Altus Group reports that total commercial real estate investments in Calgary in the second quarter of this year came to $531 million, while it tallied $545 million in Edmonton.

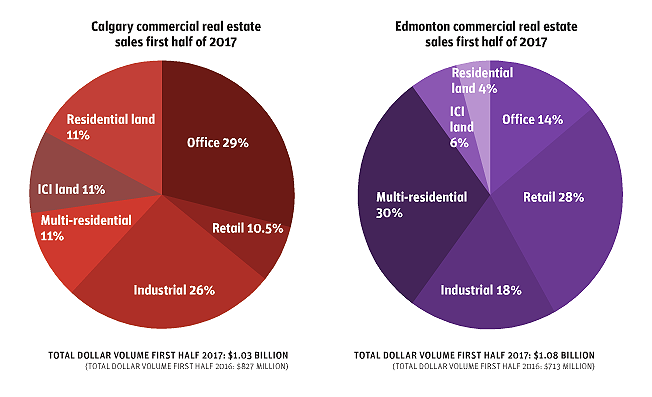

For the entire first half of 2017, Calgary saw a 24 per cent increase in the total dollar volume of real estate transactions, pushing it to more than $1 billon, reports Barclay Street Real Estate. In the same period, Edmonton transactions were also slightly higher than $1 billion, up 52 per cent from the first half of 2016.

“The light at the end of the tunnel is getting stronger,” said David Wallach, president of Barclay Street Real Estate.

But while the dollar volumes are similar, the investment targets differ in the two cities.

Calgary

Calgary’s real estate investments in 2017 are focused on two sectors: office and residential land. The former was led by the sale of 12 office properties owned by Dream Office Real Estate Investment Trust to Slate Properties for more than $200 million. Considering record-high office vacancies in Calgary, an uptick in office sales is considered a sign of confidence in the city’s potential.

Residential land sales, which totalled more than $175 million in the first half, were boosted by the $40.7 million sale of the Sam Livingston Building, which is seen as a high-density residential play. Total dollar volume in 2017 for residential land was up from $79 million during the first half of 2016.

On the industrial front, Calgary posted a decrease in dollar volume, falling to $270 million, down from $316 million in the first half of last year. The average price per square foot dropped to $186, down from $203 a year earlier. However, Altus reports that industrial accounted for 23 per cent of total dollar volume in the second quarter, the highest of any real estate sector.

The smallest contributor was retail with 10.5 per cent of the total, a marked contrast from the pace that retail had been setting in Calgary. In the first half, total retail transactions accounted for $74 million in transactions, about half the $137 million at the same time last year. The biggest single retail deal so far this year has been the $9 million sale of Roxboro River Shoppes to Sun Holdings. Despite the slower sales, the average price per square foot for retail hit a record high of $417, led by the sale of two Scotiabank outlets, one of which sold for $921 per square foot.

Edmonton

In the capital city, the investor focus in 2017 is clearly on retail and office properties.

At more than $304 million, investment in Edmonton retail was about five times higher than in the first half of last year, and the price per square increased to $413, up from $375 in 2016 and $305 in pre-recession 2014.

The office sector showed a huge increase, with transactions reaching $149 million in the first half, up from $45.5 million at the same time a year earlier.

The industrial market also showed strength. In the first half, 41 industrial transactions were reported at a dollar volume of $193 million, on pace to match 2016, which posted a total dollar volume of $445.9 million. The average price per square for industrial this year hit $211, up from $177 in 2016 and the highest level in at least five years.

A soft spot in Edmonton is residential land sales, which experienced a decrease from 2016. In the first half, 11 residential land deals were made for a total dollar volume of $43 million, down from 31 sales and a dollar volume of $126 million at the same time last year.

However, sales of multi-family buildings accounted for 30 per cent of Edmonton’s commercial real estate transactions, at $325 million, up 20 per cent from 2016.