While many analysts and pundits decry the economic woes of Alberta’s biggest city, Calgary has tapped into a new economic pipeline that has delivered the highest commercial real estate sales in six years.

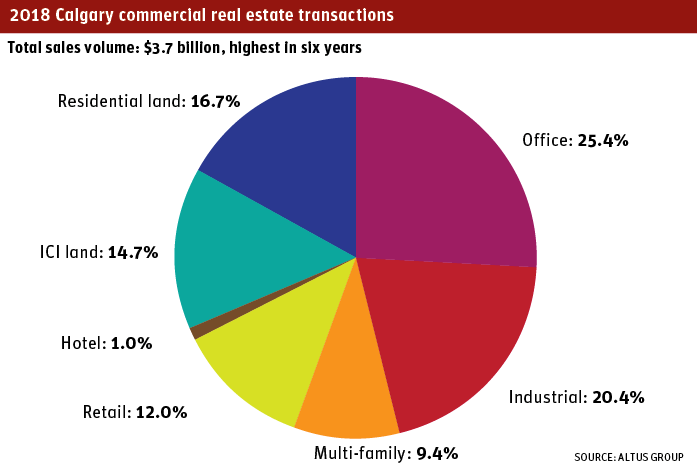

Total commercial real estate deals in 2018 topped $3.7 billion in Calgary, a level below only the record-setting performance of 2012, two years before oil prices crashed.

The industrial sector had its best year in the past decade, with 132 transactions worth $758 million, reports Altus Group, noting 2018 investment values surged 14 per cent from a year earlier.

Big players accounted for much of the industrial action, an indication of the confidence of corporate Canada in Calgary’s recovery. Investment giant Manulife paid $36.3 million in the fourth quarter of last year for an industrial site in northeast Calgary, where it paid $162 per square foot. Skyline Real Estate Investment Trust paid $37.6 million for an industrial property in the southeast. In the same three-month period, Enright Capital Ltd. and Crestpoint Real Estate Investments snapped up a logistics facility and development land in southeast Calgary for $36.7 million.

Led by warehouse and transport demand, Calgary has 3.5 million square feet of industrial under construction. with 1.5 million square feet set to open this year, according to Cushman & Wakefield. In the fourth quarter 2018, more than 8.8 million square feet of industrial space was leased up at an average net rent of $9.07 per square foot, the commercial agency reported.

Calgary’s retail sector investments also defied skeptics, posting a 14 per cent increase in transactions during 2018. Big deals included LaSalle Canada Property fund buying the Market at Quarry Park for $52.7 million. Earlier in the year, Calgary-based Boardwalk Real Estate Investment Trust partnered with RioCan Real Estate Investment Trust to start a 162-unit multi-residential rental tower in the Brentwood Village shopping centre in Calgary. The mixed-use development will include a 12-storey high-rise with about 130,000 square feet of rental housing and 10,000 square feet of retail.

Multi-family rentals in Calgary appear a safe bet. Mainstreet Equity Corp., one of the largest landlords in Alberta, has been buying in Calgary all through the downturn and it has paid off.

“Mainstreet managed to not only survive but thrive in 2018, producing our best annual results since the recession began in 2014,” the company reported in January.

“This included a return to double-digit growth across all of our key real estate metrics. NOI [net operating income] grew 12 per cent compared with 2017 while FFO [funds from operation] per share grew 18 per cent and rental revenues increased 11 per cent,” the company reported.

In the fourth quarter of 2018 alone, Mainstreet spent $35.7 million buying seven apartment buildings, including five in Calgary. The cost of the Calgary apartment blocks, all mid-market properties, ranged from $126,700 to $162,500 “per door.”

New hotels

Calgary, which will host the Grey Cup this November, is also seeing a surge in hotel investments, led by the opening of the world’s largest Residence Inn by Marriott in Calgary’s downtown on March 1.

Developed by Atlific Hotels, the new Marriott soars 33 floors on the border of the Beltline, with 390 rooms and 6,000 square feet of meeting space. This is Calgary-centric: the interior design features floor-to-ceiling western -theme murals and cowboy boot stitching incorporated into all guestroom bed headboards.

“We are thrilled to be opening a spectacular new addition to Calgary,” said Gordon Johnson, vice-president, operations, for Atlific Hotels. “The Residence Inn by Marriott Calgary was envisioned for today’s leisure and business traveller to spend quality time in one of Canada’s most vibrant entrepreneurial cities.”

General manager Eric Ashton, who grew up in Jasper, leads the hotel’s team. “While this is the largest Residence Inn by Marriott in the world, we have taken special care to create a welcoming hotel with a modern boutique feel.”

“Calgary has a vibrant culture and a wonderfully compact downtown to explore. In the downtown alone there are 200 restaurants and dozens of theatre venues, art galleries and museums,” noted Dave Sclanders, executive director, Meetings + Conventions Calgary.

In 2018 The Economist ranked this multicultural city (120 languages are spoken in Calgary) and economic powerhouse as the fourth most livable city in the world. In addition, Calgary took Cvent’s 4th top meeting destination in Canada designation and the No. 3 ranking in North America for its business friendliness by fDi Intelligence’s American Cities of the Future.

A string of architecturally significant buildings are also drawing attention to Calgary. The National Music Centre, designed by the Portland, Oregon, firm Allied Works Architecture launched last year. The facility is part museum, part performance centre, and part interactive incubator.

The latest building to hit the city’s stage is Calgary Central Public Library in the East Village, a joint design between Canada’s DIALOG and Norwegian architects Snøhetta, which opened in November 2018.

Calgary’s hotel sector has taken a beating over the past four years as oil prices sank, but analysts now see it as an opportunity for investors. And hotel operators are taking note.

Recently PHI Hotel Group opened three Marriott-brand hotels in Alberta in 50/50 partnership with Siksika Resource Development Ltd., including the 247-room Westin Calgary Airport and Conference Centre at the Calgary Airport .

PHI Hotel Group itself also recently opened the 157-room Holiday Inn and Conference Centre in Calgary South.

In all, Calgary will see 1,000 new hotel rooms open this year, according to Carrie Russell, senior managing partner in HVS, an international hotel consultancy firm.

Russell is picking Alberta and particularly Calgary as a hotel investment target. She doesn’t expect any distress sales, despite a province-wide occupancy rate of 57 per cent. Some smaller centres are seeing an uptick in occupancy levels, she noted.

“The last four years have been challenging in Alberta,” Russell told Western Investor, “[but] the province had one of the strongest demand growth rates in the country in 2018 as the economy continues to improve and drilling activity has increased in some areas.”

Russell expects a number of smaller hotel properties to be put up for sale this year in Alberta as the flashier new competition comes on stream.

“This could present some interesting opportunities wherein buyers could acquire assets at the low point in the cycle,” she noted.