March was the 25th month in a row that the number of Greater Victoria home sales slumped compared with the same month a year earlier.

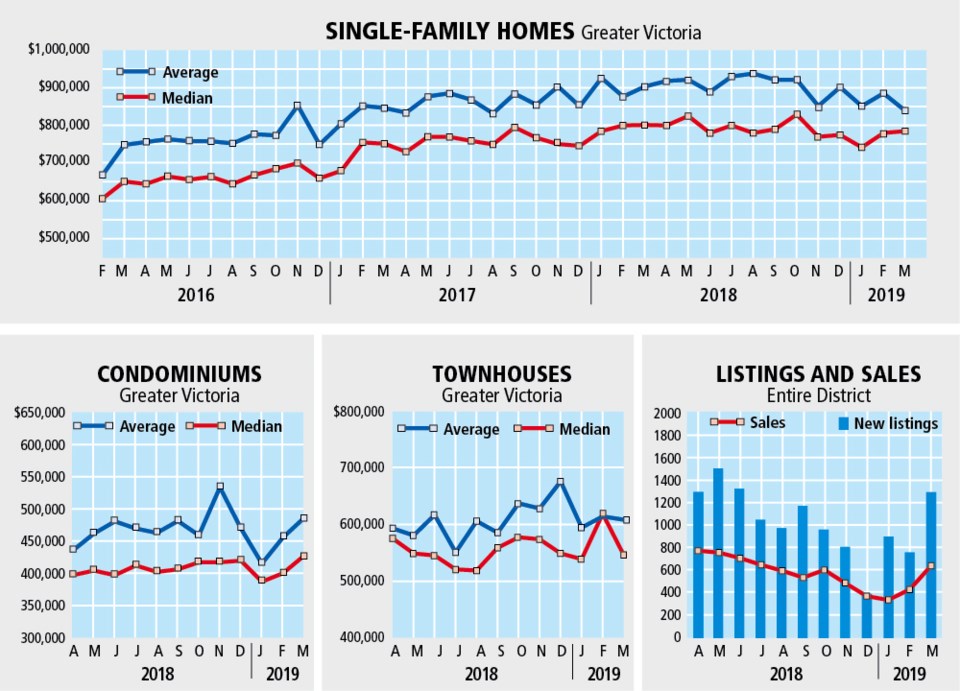

A total of 640 mainly residential properties sold through the Victoria Real Estate Board in March, down seven per cent with 688 sales in the same month in 2018. February delivered 421 sales.

November 2017 was the most recent month when sales increased compared to the same month in the previous year. (671 compared with 599 in November 2016). But now that spring is here — a traditionally strong real estate period — the market has picked up somewhat as sales numbers jumped by 52 per cent in March from February.

The number of properties on the market is also climbing, giving buyers more choice. A total of 2,435 properties are currently for sale, up from 1,766 in March 2018.

New federal borrowing rules, which can restrict the size of loans for buyers, resulted in competition for lower-priced properties, the board said.

“This means that even though sales are slower than the peak in 2016, many buyers can expect to encounter multiple-offer situations as competition increases at lower price points,” board president Cheryl Woolley said in a statement April 1.

She predicts that the lower-priced market will heat up even more now that the federal government has introduced a program for first-time buyers of properties costing $480,000 or less. The federal government will loan up to 10 per cent of the housing price.

“These current market dynamics make it increasingly important for our region to continue to find ways to create more affordable housing options to avoid price pressure on the lower-priced properties,” Woolley said.

Despite the year-over-year drop in sales and some downward movement in single-family prices, capital region housing prices remain among the highest in the country.

Last month, the benchmark price for a single-family house in the region was $741,000, down from $746,300 in March 2018, the board said.

The core area saw the benchmark for a single-family home move down to $843,600 from $867,900 a year earlier.

The West Shore was the only region with an increase in the single-family benchmark, rising to $625,100 from $609,300.

Benchmark refers to the price of a typical property in a specific area. The core covers Victoria, Saanich, Esquimalt, Oak Bay and View Royal.

Condo and townhouse prices climbed overall in the region year-over-year.

The benchmark for condos came in last month at $497,100 from $491,100 a year ago in March. The benchmark for townhouses was $598,000 last month, up from $563,000 in March 2018.

The sales picture is similar north of the Malahat. The number of single-family house sales slipped to 309 in March from 399 in March, 2018, said the Vancouver Island Real Estate Board.

Even so, prices were up. The benchmark value for a single-family house was $510,800, up six per cent year-over-year.