Commercial real estate sales value was down 15 per cent in 2018, but investors remain bullish on strata assets.

Real estate data company Altus Group’s latest quarterly findings report a total of 2,002 commercial transactions over $1 million in 2018, totaling 12.5 billion. 2017 posted 14.6 billion in sales.

“Demand remains strong for investment properties in the Vancouver market area, despite the challenges in 2018; rising interest rates, trade tariffs and provincial government intervention,” the report reads.

Land sales experiencing the sharpest decline, with overall investment value dropping 18 per cent year-over-year. However, land sales including holding income from rental properties or lease-back agreements remained strong. The priciest sales were located in Burnaby, Vancouver or Richmond.

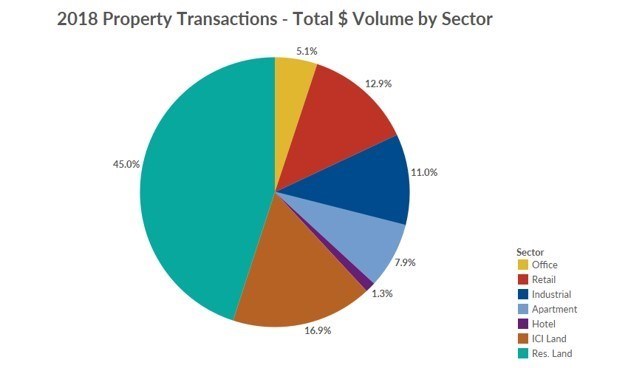

Despite the decreasing in transaction value, land investment still accounted for 62 per cent of commercial sales in 2018.

Office, industrial and retail strata markets were the star performers of the year, representing $778 million in overall investment. Retail and industrial strata sales increases 34 and 37 per cent respectively, while office strata soared 137 per cent as new supply completed in suburban markets.

“Record low vacancy rates in the office and industrial markets and favourable interest rates, are all primary drivers in the success of strata properties in 2018,” the report states.

Industrial and apartment demand continues to far outpace supply, with interest from both local and national private investors vying for space. However, investor sentiment moving forward expressed some trepidation toward industrial assets.