The City of Vancouver now has the lowest tax rate for commercial property among major Canadian cities, but Vancouver has shifted the burden to residential real estate, creating the most heavily-taxed homeowners in the country.

With a decrease of 27.9 per cent from 2010, Vancouver posted the largest drop in commercial rates out of 11 cities surveyed by the Altus Group for its 2020 Canadian Property Tax Rate Benchmark Report, released October 26. The 17th annual survey, done in conjunction with the Real Property Association of Canada, also revealed a sharp shift in how commercial and residential properties are taxed.

The tax shift is measured by a commercial-to-residential ratio that compares the commercial tax rate to the residential tax rate. For example, if the ratio is 2.50, a commercial property valued at $1 million dollars would incur property taxes 2.5 times higher than an equally-valued residential property.

Because of the pandemic, many cities have shifted the tax burden away from businesses, which resulted in a decrease of the commercial-to-residential tax ratios in 2020.

Calgary’s commercial tax rate dropped by 11.9 per cent in 2020 from a year earlier, reversing the four-year trend of posting the largest increases in commercial tax rates in the study from 2016 to 2019.

Altus noted that “Calgary City Council has had no choice but to shift more of the tax burden to residents due to the skyrocketing taxes on small businesses over the last three years. The downtown Calgary office market continues to struggle due to elevated rates of vacancy and declining lease rates which are driving down office assessment values.”

Vancouver was particularly aggressive in shifting taxes from the business sector to homeowners.

Vancouver’s commercial-to-residential tax ratio dropped a stunning 36.8 per cent in 2020 from a year earlier to a historic low of 2.3, and the largest decline of all cities surveyed, Altus found. This decrease took Vancouver from the third highest ratio in 2019 to the fourth lowest in 2020.

In comparison, the average national commercial-to-residential tax ratio in Canada is now 2.65, down 6.6 per cent from 2019.

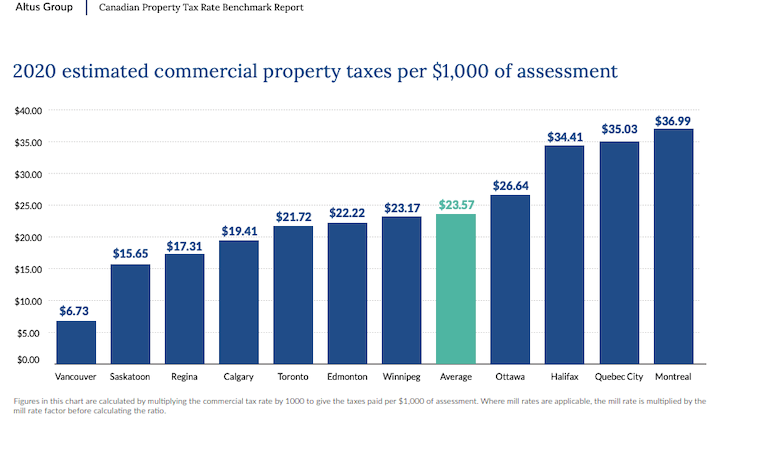

“[This] marks the fifteenth year in a row that Vancouver’s commercial rates have gone down. Over the last five years, Vancouver’s commercial tax per $1,000 of assessment has dropped 55.3%, going from $15.05 in 2015 to $6.73 in 2020, “ Altus reported.

The city cannot take full credit for the dramatic cut in commercial taxes: the drop was largely driven by a B.C. government’s decision in April to reduce the school tax portion of the commercial tax mill rate by 70 per cent this year as part of its COVID-19 Action Plan.

The tax shift has dinged Vancouver owners of homes, which remain the highest priced in the country.

Vancouver posted the largest increase in residential tax rates in Canada this year, with a 14.2 per cent increase from 2019, the Altus report reveals.

Calgary saw the second largest commercial-to-residential ratio decrease of all cities, down 22.05 per cent to 2.58. The decrease in the ratio was a result of a significant increase in the residential rate (13.05 per cent) and the big decrease in the commercial tax rate.

Edmonton sits below the national average with a commercial-to-residential tax ratio of 2.38 and has remained relatively stable over the last five years.

Regina remains quite stable, posting a 1.74 commercial-to-residential tax ratio.

Saskatoon continues to have the lowest commercial-to-residential tax ratio at 1.72, a very slight increase from last year’s ratio of 1.71.

Winnipeg continues to be the third lowest of the 11 cities with its commercial-to-residential ratio remaining relatively flat at 1.94.