Multifamily investment properties in major Alberta cities have not decreased in value, despite the province’s economic downturn, a new report states.

Although rental vacancy rates have risen dramatically across the province, prices for rental properties in Calgary and particularly Edmonton have not dropped significantly, making the multifamily market one of Alberta’s most secure real estate asset classes.

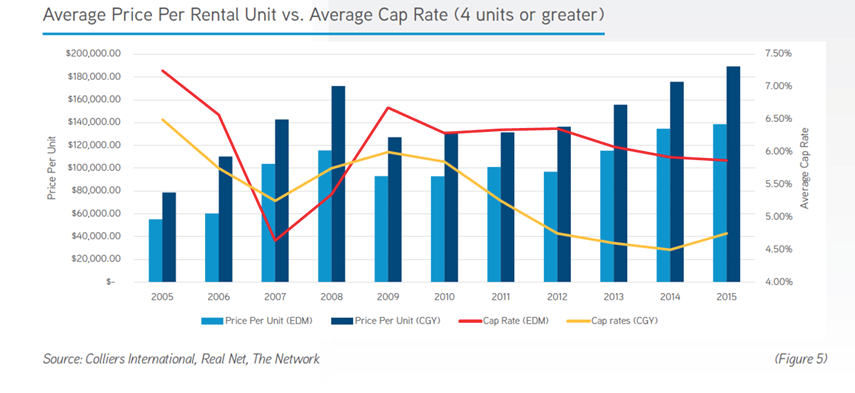

According to a third quarter multifamily market report released by Colliers International, Calgary and Edmonton multifamily transaction values for 2016 are projected to match or surpass 2015’s high values. Edmonton transactions, for example, totaled $420 million in 2015, the highest sale value since 2007. Per-unit prices have also increased considerably against the province average. However, due to limited supply and current economic uncertainty, there has been a decrease in the number of transactions, made up for by the rise in prices.

“When the economy takes a downturn, other asset classes such as industrial, office, and retail tend to suffer,” said Amit Grover, vice-president of Colliers’ Edmonton multifamily team. “Multifamily is the safest investment type and therefore demand increases because investors are in search of a safe investment to generate cash flow.”

One of the biggest drivers behind the rental investment market in Alberta is a considerable millennial population, who likely cannot afford to buy their own property. The report states, “a growing millennial population seeking employment in Alberta will likely result in a rising demand for rental units.” Curtis Scott, manager of market intelligence for Colliers in Vancouver, agrees.

“[Millennials] will either be in school or working an entry level job. As such, renting is mostly their only option, other than living at home with family,” he said. “That said, with competition increasing as more supply enters the market, developers with projects near transit and amenities are far more likely to attract this age group.”

As residents of secondary cities in Alberta continue to migrate towards Edmonton and Calgary following wildfire destruction in places like Fort McMurray and the oil recession in Red Deer, a lack of rental stock in these big cities are keeping prices for rental properties at nearly pre-recession values.

“I wouldn’t necessarily say [prices staying consistent] is a sign of recovery in the energy market, but more a result of people looking for flexibility due to uncertain times,” Scott explained.