Home prices have been in a sharp retreat in Metro Vancouver, Canada’s second largest investment market, ever since the British Columbia government introduced a foreign buyer tax in mid-2016. The concern for some is that commercial property prices will be pulled down by the residential sector. Recent price history suggests that won’t necessarily be the case, however.

When I visited Vancouver earlier this year, market participants seemed to be waiting for the next shoe to drop. With single-family homes and commercial properties competing for land, the thinking is that the decline in residential prices will bring down land values, and in turn bring down commercial property prices to the same degree as residential assets.

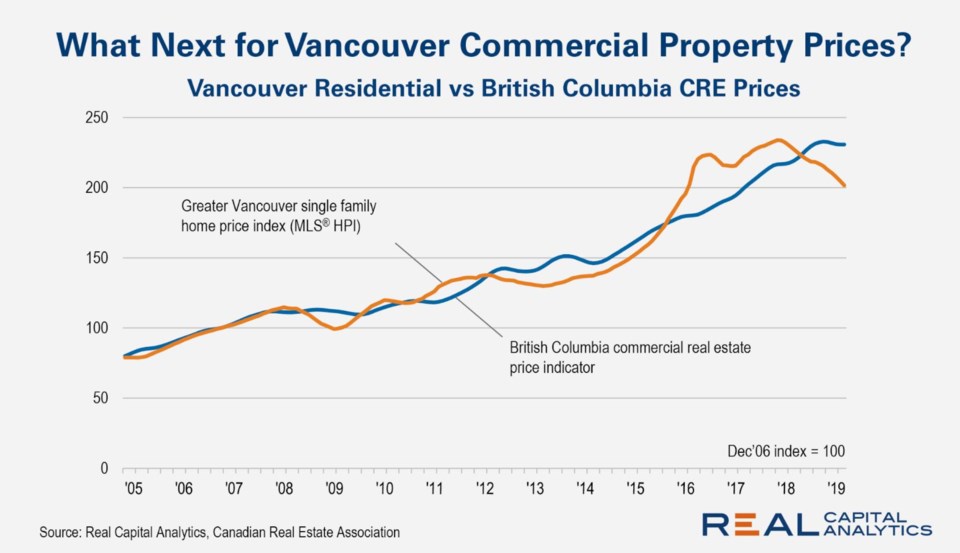

Historically, these price series had moved together. From 2005 to 2014 each exhibited a six per cent compound annual growth rate (CAGR) with only a few bumps and differences between the series over time.

This link lends credence to the argument that a transmission vehicle such as land prices might translate the decline in single family prices over to the commercial sector, forcing these price series to converge once again.

The convergence evident over the longer history is not true of recent trends, however:

• Commercial property prices did not participate in the run-up of prices to the same degree as the residential sector. Given the intense interest by cross-border buyers for residential assets in Vancouver, single family home prices grew at a faster pace than commercial properties from 2014 to 2017. The Canadian Real Estate Association MLS® HPI for Vancouver single family assets grew at a 17 per cent CAGR from 2014 to 2017. A custom Real Capital Analytics (RCA) commercial property price indicator for British Columbia grew at only an 11 per cent CAGR over the same time period. This CAGR was sizeable and put B.C. in the same league as other global technology hubs like San Francisco, but prices for the residential sector moved far ahead of commercial properties.

• When the B.C. government introduced the foreign buyers tax, residential property prices slid as a pool of buyers left the market, deterred by the tax on purchase prices (introduced at 15 per cent and since raised to 20 per cent). From January 2018 to May 2019, the Vancouver single family price index has fallen a cumulative 14 per cent. (Growth in single family home prices across Canada have been stalling too, in part because of costs related to risk management for residential mortgages.) Over the same time frame, commercial property prices for B.C. have climbed a cumulative seven per cent.

Commercial property prices in B.C. have fallen slightly in 2019 – down a cumulative one per cent into May from the end of 2018. This decline came at a time when the yield on the 10-year benchmark bond in Canada fell from 2.5 per cent to 1.5 per cent which, when combined with record low commercial property vacancy in Vancouver, should shore up the value of the income streams from these commercial assets.

Yes, prices are down slightly, but a one per cent decline is indicative of flat prices. Unless an owner is forced to sell assets in a distressed situation, there just is not the incentive to cut sale prices the same way for commercial assets as there is in the residential sector. (It should be noted that the sale of the Bentall Centre portfolio in 2016 did not enter into the construction of the RCA B.C. commercial property price indicator, nor will its announced sale in Q2 2019 enter the data set.)

If owners of commercial assets are unwilling to sell, commercial property prices can remain flat or even grow in line with the favorable income trends for assets in the region. Such positive trends could happen even as residential prices slowly recover from the introduction of the foreign buyer tax. Convergence in price trends might not mean commercial prices falling off a cliff, but instead residential prices facing a steady climb in the years ahead.

Jim Costello is senior vice-president at commercial real estate analysis firm Real Capital Analytics. Email him at [email protected].

This article was originally published on Real Capital Analytics’ website here.