Canada’s export credit agency has approved financing a major liquefied natural gas terminal in British Columbia — a plan four environmental groups recently warned breaches the federal government’s 2021 commitment to end funding of all new domestic fossil fuel projects.

For weeks, Export Development Canada (EDC) had listed its latest “Category A” project disclosure as a proposed loan for the Cedar LNG facility near Kitimat, B.C. The class of project applies to those considered to have “potential significant adverse environmental or social effects that are sensitive, diverse, or unprecedented.”

“On June 25, 2024, Export Development Canada (EDC) signed financing for this project, as part of a wider lending group,” confirmed EDC senior advisor Zoé de Bellefeuille in a statement to Glacier Media Tuesday afternoon.

The EDC loan to Cedar LNG ranges between $400 and $500 million, and will support the development of the facility and “associated onshore infrastructure,” said de Bellefeuille. It's part of a larger $5.5-billion project Kitimat announced in a final investment decision Tuesday.

The project will be built by the Haisla First Nation, which owns 50.1 per cent per cent of the project, and Pembina Pipeline Corp, which owns 49.9 per cent.

The EDC spokesperson said the Crown corporation's mandate is to help Canadian export companies grow internationally, and that one of its key priorities is to support Indigenous businesses as they pursue “economic self-reliance and growth through exporting.”

“EDC’s financing for this project is aligned with our focus on supporting the global energy transition and Indigenous economic reconciliation,” added the statement. “The Cedar LNG project is the first Indigenous-majority-owned natural gas project in the world and is expected to also provide significant jobs to Haisla Nation members, members of other local Indigenous groups, and the local community over the life of the project.”

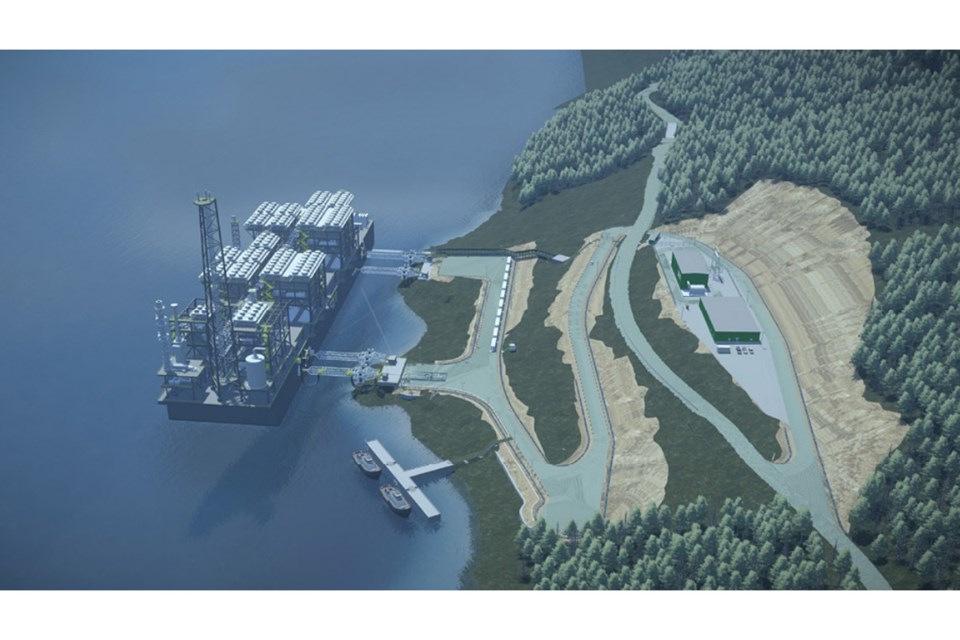

The proposed floating facility would be fed by the Coastal GasLink pipeline. The facility would cool gas to minus 162 degrees Celsius, transforming it into a liquid. From there, it would be loaded onto ships and exported to Asia.

Project proponents say it would generate 100 full-time jobs while having “one of the cleanest environmental profiles in the world.”

De Bellefeuille said “the Cedar LNG project will be primarily powered by B.C.’s clean hydro-electricity," making it one of the world’s "lowest GHG emission natural gas operations.”

But according to a letter — signed by four environmental advocacy groups and directed to Deputy Prime Minister and Minister of Finance Chrystia Freeland and EDC head Mairead Lavery — funding the project breaches the “spirit” of a government commitment to end public financing of new fossil fuel projects.

Cedar LNG’s claims that it would produce “net-zero” emissions but does not count the “bulk of emissions, including fugitive emissions and downstream combustion emissions,” states the letter signed by Environmental Defence Canada, David Suzuki Foundation, Climate Action Network Canada, and Oil Change International.

“LNG expansion is not in line with commitments, and unlikely to be economical over the span of the project,” reads the letter.

“The adverse environmental effects of this project are too significant and funding this project cannot be justified.”

The four groups cite recent forecasts that show renewables are becoming more competitive with less volatile pricing than fossil fuel prices.

“Consequently, the International Energy Agency and other forecasts project a glut in LNG supply by mid-decade that will drive down prices, combined with a levelling off of gas demand in Asia,” they claim.

Freeland's office declined to comment, instead deferring to Export Development Canada. In its statement, EDC said the project would have the opposite effect stated in the letter from the environmental groups and adheres to Canada's climate commitments.

The Crown corporation no longer provides new insurance, bonding or guarantees for Canadian oil and gas producers’ international upstream and downstream operations, said de Bellefeuille. She said the EDC’s support for renewable power generation has increased 41 per cent year over year and totalled $8.9 billion in 2023 — ahead of its $10-billion target for 2025.

“We adhere to Canada’s federal climate policy commitments. This is why as of Jan. 1, 2023, EDC no longer provides new direct financing to the unabated international fossil fuel sector,” said the spokesperson.

“This aligns with our commitment to the Government of Canada’s emissions reduction plans, and is consistent with the Paris Agreement and our adherence to the Glasgow Statement.”

With files from Nelson Bennett